“Today’s inflation report,” US president Joe Biden told us on March 10, “is a reminder that Americans’ budgets are being stretched by price increases and families are starting to feel the impacts of Putin’s price hike.”

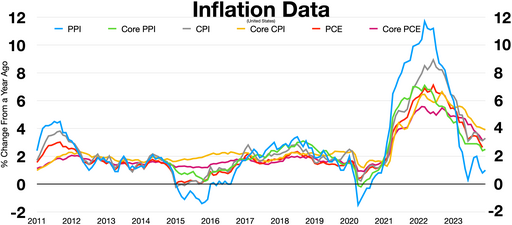

It’s the latest in a long line of dodges on the causes of US inflation, which took a dive in early 2020, then began its steady climb toward the current official rate of 7.9%.

The first explanation was that inflation increases were “transitory.” That explanation made sense. Or would have, anyway, if Congress and the Biden administration had brought government borrowing and spending levels back to pre-COVID-19 levels. Instead, they decided to go bigger. When the causes aren’t “transitory,” the effects won’t be either.

Because Biden and Congress were unwilling to rein in borrowing and spending (requiring the Federal Reserve to continue flooding the economy with newly created money), new excuses were required.

Next came “well, if you really think about it, inflation is GOOD — look, higher wages!” And, the US Labor Department did report an average pay increase 4.7% in 2021. But since prices jumped by at least 7%, those “higher wages” actually amounted to significant pay cuts.

“Corporate greed” looked like the administration’s last pitiful stand. Companies were hiking their prices for no good reason except to line their pockets, those scoundrels! Their own higher costs for labor and for their supplies and inputs couldn’t possibly have anything to do with it.

It looked like the game was up. “Corporate greed,” the last refuge of the inflationary scoundrel, didn’t pass the smell test either. The administration was fresh out of excuses. There was really nowhere left to go except admitting the truth:

Inflation is caused by increasing the money supply faster than society increases its production of goods and services for sale. Everything else is an effect, not a cause.

If we want lower inflation, the Fed has to stop creating huge numbers of dollars out of thin air, making the dollars in our wallets and bank accounts worth less (even, eventually, worthless).

The bare minimum requirement for THAT to happen is for Congress to stop borrowing all those trillions of those dollars. In fact, the ideal cure for inflation would be a free market in money that sends the fiat dollar to the dustbin of history in favor of competing currencies backed by promises or commodities more substantial than the “full faith and credit” of a government no one should trust at all.

Unfortunately, Vladimir Putin came to Biden’s rescue and gave him yet another lame excuse to draw out pain instead of facing, and acting on, the truth.

Don’t buy that excuse. Even if you can afford to. And with today’s inflation rates, you probably can’t.

Thomas L. Knapp (Twitter: @thomaslknapp) is director and senior news analyst at the William Lloyd Garrison Center for Libertarian Advocacy Journalism (thegarrisoncenter.org). He lives and works in north central Florida.

PUBLICATION HISTORY