Planned Parenthood pops up regularly on the political radar as “pro-choice” and “pro-life” activists wage their decades-long battle over abortion. The latest controversy is over a series of videos released by a “pro-life” organization, purporting to show that Planned Parenthood is in the business of selling what pro-choicers call “fetal tissue” and pro-lifers call “baby parts” to medical research companies. And as usually happens when such controversies arise, there’s a move on in Congress to “de-fund” Planned Parenthood.

I’m not interested in re-litigating the issue of abortion per se here (that argument will never end), but I do think it’s important for all of us — “pro-choice” and “pro-life” alike — to understand what Planned Parenthood is and how it operates.

Ideological considerations aside, abortion in America is an industry, and Planned Parenthood is a business. It calls itself a “non-profit,” but in legal parlance all that means is that it isn’t owned by individuals or stockholders who rake off its profits.

Planned Parenthood boasts more than 800 local franchises and knocks down a billion dollars a year. Its CEO’s salary and benefits top half a million dollars annually; other executives and franchise managers also earn low- to mid-six-figure salaries. It IS a business, full stop.

More to the point, Planned Parenthood is a “politically connected” enterprise which games government to subsidize it and protect its business turf.

Of Planned Parenthood’s billion dollars in annual revenue, about half comes from the federal government as direct corporate welfare. Its supporters don’t call it corporate welfare, of course. They claim its services are good and necessary and that the payout is justified. Shoes and books are good and necessary too, but if Nike or Amazon asked for a $500 million check from Uncle Sugar, we all know what we’d call it.

Planned Parenthood claims to work on behalf of women’s reproductive health, but uses its political clout to lobby strongly against, among other things, congressional efforts to make many forms of birth control available “over the counter.”

Why would Planned Parenthood do that? Answer: Plain old economic protectionism. If a woman can just drop by the pharmacy at Wal-Mart for her contraception, she doesn’t have to go through Planned Parenthood’s clinics and see Planned Parenthood’s doctors for a prescription. That would help the woman, but it would hurt the case for continuing the corporate welfare checks. This tells us something about Planned Parenthood’s priorities.

When it comes to fetal tissue “donations” that are actually sales — Planned Parenthood charges a “processing fee” — it’s reasonable to assume that the organization’s involvement is self-interested. That’s not to say that fetal tissue research is good or bad, but rather simply to point out that Planned Parenthood doesn’t care deeply enough about it to take a business loss on the proposition.

When it comes to continuing the half a billion dollars in annual taxpayer funding, the answer should be “your corporate welfare is going away — sink or swim in the marketplace on your merits.”

Thomas L. Knapp is director and senior news analyst at the William Lloyd Garrison Center for Libertarian Advocacy Journalism (thegarrisoncenter.org). He lives and works in north central Florida.

AUDIO VERSION

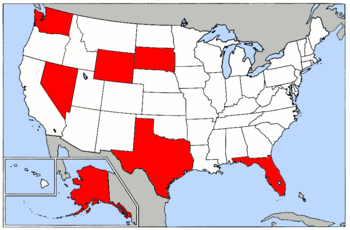

PUBLICATION/CITATION HISTORY

- “Planned Parenthood: If You Have to Ask Why, the Answer is Usually ‘Money,'” by Thomas L. Knapp, Ventura County, California Citizens Journal, 07/31/15

- “Planned Parenthood: If you have to ask why, the answer is usually ‘money,'” by Thomas L. Knapp, Muscatine, Iowa Journal, 08/01/15

- “Planned Parenthood: If You Have To Ask Why, The Answer Is Usually ‘Money,'” by Thomas L. Knapp, Iowa Free Press, 08/05/15

- “End Planned Parenthood corporate welfare,” by Thomas L. Knapp, Libby, Montana Western News, 08/04/15

- “Planned Parenthood: If you have to ask why, the answer is usually ‘money,'” by Thomas L. Knapp, Fayette, West Virginia Tribune, 08/17/15

- “Planned Parenthood: If you have to ask why, the answer is usually ‘money,'” by Thomas L. Knapp, Montgomery, West Virginia Herald, 08/19/15