As of market close April 21, major US stock indices have fallen by double-digit percentages since the beginning of the year, while bond yields — the interest rates the US government owes on money it borrows — continue to rise. But US president Donald Trump wants the Federal Reserve to cut interest rates and bears an ongoing grudge against the central bank’s chair, Jerome Powell, for refusing to do so.

In Trump’s view, “Mr. Too Late, a major loser” should, but isn’t, “pre-emptively” acting with sufficient alacrity to rescue the American economy from the consequences of Trump’s own economic idiocy.

Powell makes a convenient scapegoat, especially since he can’t be fired (though Trump occasionally pretends otherwise) and has more than a year left in his term. So until May of 2026, Trump can just continue blaming Powell for America’s economic pain instead of admitting that his tariff and trade war antics, spendthrift budget plans, etc. don’t, won’t, and can’t produce good results.

Powell and his co-conspirators at the Fed aren’t innocent bystanders. To the extent that inflation “is always and everywhere a monetary phenomenon,” as Milton Friedman correctly put it, they have plenty to answer for.

That said, the perpetual Trump-Powell boxing match misses the real problem.

The Fed shouldn’t lower — or raise — interest rates.

The Fed should dissolve, or be dissolved, and the job of “creating money” should be left entirely to a free market.

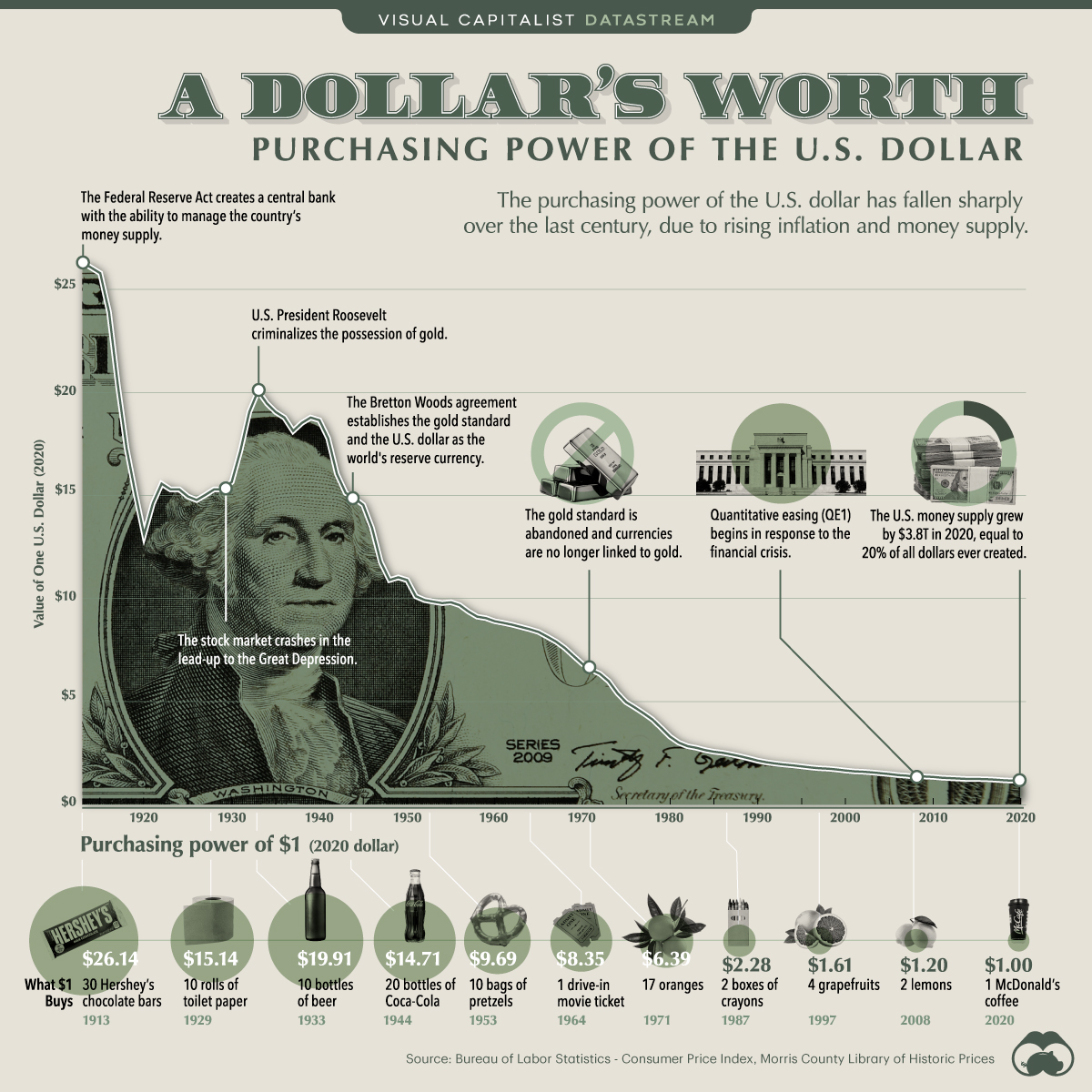

There’s simply not enough room in an op-ed column to explain the intricate processes through which the Fed has debased the value of American money over the last 112 years, but lengthy explanations aren’t really necessary. The results of giving a banking cartel a monopoly on the creation of “money,” the power to create that “money” from thin air, and a mandate to loan that “money” to politicians who can borrow as much as they want as often as they want, were predictable from the start.

When we look at the three main functions of money — medium of exchange, unit of account, and store of value — the Federal Reserve system’s product fails on two of the three.

Sure, the dollar serves as a convenient unit of account, but it’s continually and consistently worth less and less in exchange and as savings. And these days, near-instant information transfer makes it easy to compare units of account. There’s no particular reason why a troy ounce of gold or silver, a Bitcoin, or any fraction of any of those three, or any number of other instruments, can’t serve the unit of account function at least as well as the dollar, while holding their value far better in exchange and savings.

The dollar — like many other government and government-sponsored projects — continues to circle the drain, and WILL eventually go down that drain.

Expecting Trump, Congress, et al. to give up their tickets on the “free money” gravy train before the train wreck is unrealistic. But YOU can, and should, get as much of your wealth and economic activity as possible off that train.

Thomas L. Knapp (X: @thomaslknapp | Bluesky: @knappster.bsky.social | Mastodon: @knappster) is director and senior news analyst at the William Lloyd Garrison Center for Libertarian Advocacy Journalism (thegarrisoncenter.org). He lives and works in north central Florida.

PUBLICATION/CITATION HISTORY