With inflation rampaging across the US Economy, USA Today reports, Social Security recipients can expect a 2022 cost of living adjustment (“COLA”) of up to 10.5%.

For victims of the New-Deal-Era Ponzi scheme, which offers a measly return on “investment” (paid for, like all Ponzi payouts, from new revenues), and which mostly functions as a way of subsidizing the retirements of longer-lifespan white middle-class women at the expense of shorter-lifespan black low-income men, a raise is always good news.

Well, almost always.

Other things will likely be going up as well, including those same seniors’ Medicare Part B and Part D payments, (Part D increased by 14.5% this year, while the Social Security COLA was only 5.9%).

And other things won’t go up. For example, the amount of income seniors can have before that income starts getting taxed, or the amount below which they receive adjusted Medicare and prescription drug benefits for “low-income” retirees.

In at least some cases, the COLA may end up costing seniors more than they get. As Martin Luther observed of certain people in his Commentary on the Sermon on the Mount, government’s “giving is of such a character, that the right hand gives, but the left hand takes.”

The best solution to this problem, of course, would be to get America off government “giving” merry-go-round, including but not limited to the Social Security scam.

But until we can figure out how to get there (or, more likely, the system collapses), there’s another worthwhile solution — not just for Social Security recipients, but for everyone.

That solution is “indexing” tax rates and benefit thresholds to inflation.

With “indexing,” every year, the personal exemption and/or standard deduction for the federal income tax would increase by the same percentage as the previous year’s inflation (or, better yet, a little more, so that we can get real tax cuts). Maximum income levels to qualify for government benefits would likewise increase.

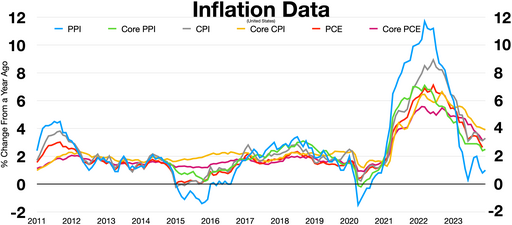

“Indexing” only seems fair. After all, inflation is itself a tax, and a highly regressive one that hurts the poor far more than the rich. It occurs when the government creates new money out of thin air faster than the productive economy produces goods and services to buy with that money, making your existing dollars worth less, so that it can have more to spend on its priorities rather than yours.

Not “indexing” taxes and benefits for inflation is, essentially, taxing you … on your taxes!

Thomas L. Knapp (Twitter: @thomaslknapp) is director and senior news analyst at the William Lloyd Garrison Center for Libertarian Advocacy Journalism (thegarrisoncenter.org). He lives and works in north central Florida.

PUBLICATION/CITATION HISTORY